POS机签购单英文翻译及POS机办理流程、申请渠道、品牌选择等全方位分析

.本文介绍了POS机签购单的英文翻译,并全面分析了POS机的办理流程、申请渠道以及品牌选择。文章涵盖了从翻译细节到实际办理过程的各个方面,帮助读者了解并选择合适的POS机品牌,以便更好地进行商业交易。摘要字数控制在100-160字之间。

POS机签购单英文翻译

POS机签购单英文翻译为"POS Purchase Receipt",这是指在使用POS机进行交易时,由POS机打印出来的交易凭证,上面详细记录了交易日期、交易金额、支付方式等信息,并由消费者签字确认购买行为。

POS机办理流程

1、了解需求:商户首先需要了解POS机的功能、价格、品牌等信息,以确定自己的需求。

2、选择服务商:根据了解到的信息,选择信誉良好、服务优质、费率合理的POS机服务商。

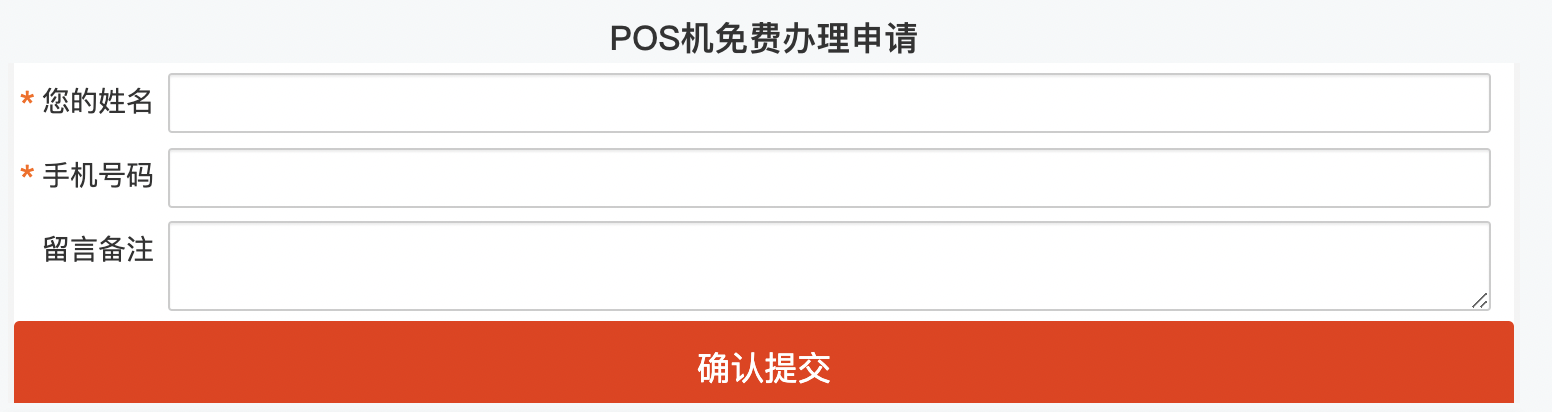

3、提交申请:填写相关申请表格,提交必要的资料,如营业执照、税务登记证、法人身份F证等。

4、审核过程:服务商会对提交的资料进行审核,确认商户的信誉和经营状况。

5、签订合同:审核通过后,与商户签订POS机服务合同。

6、安装调试:服务商为商户安装POS机,并进行必要的调试和测试。

7、培训使用:对商户的操作人员进行必要的培训,确保正确使用POS机。

8、正式使用:完成以上流程后,商户即可正式开始使用POS机进行交易。

申请渠道

1、线下申请:可以直接到银行或第三方支付公司的营业网点进行申请,现场填写申请表格并提交相关资料。

2、线上申请:通过银行或第三方支付公司的官方网站或APP进行在线申请,填写相关信息后,上传必要资料。

3、代理商申请:通过POS机代理商进行申请,代理商会协助商户完成申请流程。

品牌选择

在选择POS机品牌时,商户需要考虑以下几个因素:

1、品牌知名度:选择知名度高、口碑好的品牌,可以保证服务质量。

2、功能需求:根据商户的经营需求,选择功能齐全、操作简便的POS机。

3、价格比较:不同品牌的POS机价格可能会有所不同,商户需要根据自己的预算选择合适的品牌。

4、售后服务:选择提供良好售后服务的品牌,可以确保在使用过程中得到及时的技术支持和维修服务。

市场上比较知名的POS机品牌有:银联商务、新大陆、拉卡拉、京东金融等。

使用方法

1、开机操作:按下POS机的开机键,输入操作员号和密码,进入主菜单。

2、交易操作:选择交易类型(如消费、预授权等),输入交易金额,刷ka卡或扫码获取卡号,核对卡信息无误后,按确认键完成交易。

3、打印签购单:交易完成后,POS机会打印出签购单,消费者需在签购单上签字确认。

4、结束操作:完成所有交易后,按下POS机的结算键,进行日终结算。

手续费分析

POS机交易手续费是指商户在使用POS机进行交易时,需要支付给银行或第三方支付公司的费用,手续费的大小与交易金额、行业类型、支付方式等因素有关,零售业的费率相对较低,而餐饮、娱乐等行业的费率可能会稍高一些,不同的支付公司可能会有不同的费率政策,商户在选择服务商时需要详细了解并比较不同公司的费率情况。

在选择和使用POS机时,商户需要了解POS机的英文翻译、办理流程、申请渠道、品牌选择、使用方法和手续费等方面的信息,通过本文的介绍,希望能为商户在选择和使用POS机时提供全面的指导和帮助。

Title: Analysis and Discussion on the English Translation of POS Machine Receipt Orders

Introduction:

The English translation of "POS machine receipt order" is crucial for understanding the financial transactions made at a point of sale (POS) terminal. This document serves as a record of all transactions processed by the POS, including customer information, transaction details, and any fees or charges incurred. In this analysis, we will explore various aspects of the English translation, such as its structure, terminology, and implications for POS applications.

1、Structure and Content:

The structure of a POS machine receipt order typically includes the following elements:

- Customer Information: Name, Address, Phone Number, etc.

- Transaction Details: Date, Time, Description of the Transaction, Amount, Currency, and any applicable taxes or surcharges.

- Fees and Charges: Any additional fees or charges incurred during the transaction, such as processing fees, handling charges, or late payment penalties.

- Payment Method: The chosen method of payment, such as credit card, cash, or mobile payment.

- Remarks: Any special instructions or comments made by the customer.

2、Terminology:

In the English translation of a POS machine receipt order, it is essential to use clear and precise terminology to ensure accurate communication between parties involved in the transaction. Some common terms and phrases include:

- "Credit Card": A payment method where the cardholder authorizes the merchant to charge their account for the purchase.

- "Cash": A payment method where the customer pays cash directly to the merchant.

- "Mobile Payment": A form of electronic payment using a mobile device, such as a smartphone or tablet.

- "Receipt": A paper document issued by the merchant to the customer after the transaction has been completed.

3、Implications for POS Applications:

The English translation of a POS machine receipt order plays a vital role in the development of POS applications. It ensures that the software can accurately interpret and process the data from the receipt order, allowing for seamless integration with other financial systems and processes. Additionally, a well-translated receipt order can help reduce errors and improve customer satisfaction by providing clear and accurate information about the transaction.

4、Challenges in Translating:

One challenge in translating POS machine receipt orders is ensuring that the translated text accurately conveys the original intent of the original language while maintaining clarity and readability in the target language. Additionally, cultural nuances and regional variations may require adjustments to ensure that the translation accurately reflects the intended meaning in different contexts.

5、One-on-One Questions and Answers:

Q: What is the structure of a typical POS machine receipt order?

A: A typical POS machine receipt order includes customer information, transaction details, fees and charges, payment method, and remarks. The structure varies depending on the specific requirements of the business and the software used for processing transactions.

Q: How does the term "credit card" affect the structure of a POS machine receipt order?

A: The term "credit card" should be included in the structure of a POS machine receipt order as it specifies the payment method used by the customer. The credit card number and expiration date are also important details that need to be recorded in the receipt order.

Q: What are some common phrases used in POS machine receipt orders?

A: Common phrases used in POS machine receipt orders include "credit card," "cash," "mobile payment," "receipts," and "remarks." These phrases provide clear guidance for the merchant to accurately record the transaction information in the receipt order.

Q: How do the implications of a well-translated POS machine receipt order impact the success of POS applications?

A: The implications of a well-translated POS machine receipt order have a significant impact on the success of POS applications. Accurate and clear receipt orders can improve customer satisfaction by providing clear information about the transaction and reducing errors. Additionally, well-translated receipt orders can facilitate seamless integration with other financial systems and processes, improving overall efficiency and accuracy.